|

Dr.

Hongbao Ma, who is

running for the New York State Governor,

2026

Ma for New York

718-404-5362

mafornewyork@gmail.com

http://www.maforny.com

Hongbao Ma, PhD from

Peking University and postdoctoral fellow from Harvard University, has been

concerned about social affairs, conditions and development since he was a

child, and is enthusiastic about social activities. Facing the prosperous

and powerful side of New York and the serious existing problems, he is

running for the 2026 New York State Governor, to work hard for New

York's governance, security, education, technology, development, prosperity,

etc., focus on New York's social governance, life and development, and

committed to improving the quality of life of New York residents and

improving the current social situation, making the good places even better,

correcting the bad things and further build New York into a beautiful

homeland of prosperity and development, harmony and mutual assistance,

safety and happiness.

Campaign Slogan:

Do the Right, Do the

Best, We the People!

Let the good things be better, and the bad things be corrected!

Reasons for candidacy:

New York is the most powerful and prosperous place in the world. New York

City ranks the first among the world's metropolises, a city that millions of

people yearn for. Although it is extremely prosperous and luxurious, it also

suffers from poverty, decay and problems. In order to improve the quality of

life of New Yorkers, carry forward the quality of inheriting positive

energy, and keep New York prosperous forever, Hongbao Ma decided to run for

the New York State Governor in 2026 to contribute to New York’s governance,

security, education, technology, development and prosperity, etc. He will

work hard to improve the quality of life of New Yorkers and improve the

current situation of New York, putting people first, and public opinion

first! Do what is right and do the best! Make the good parts better, correct

the bad parts, and further build New York into a beautiful homeland of

prosperity, development, harmony, mutual assistance, safety and happiness.

Key points of the policy agenda:

1. Universal Basic Income (UBI), unconditional, All New Yorkers.

2. Universal free basic medical insurance for all New Yorkers.

3. Zero poverty, zero crime, zero homelessness, Zero unemployment, zero

dollar owed, zero bad tenant.

4. Increase New York's GDP, social and economic development, per capital

assets, education, infrastructure, and happiness index, significantly.

The first things to achieve:

1. Universal basic income and free basic medical insurance for all,

unconditionally for every New Yorker;

2. Zero poverty, eliminate poverty;

3. Zero crime, zero tolerance of crime, and elimination of crime caused by

poverty;

4. Zero homelessness, eliminating homelessness caused by poverty;

5. Zero unemployment, abolish the minimum wage and achieve zero

unemployment;

6. Zero dollar arrears, eliminating arrears or refusal to pay dues to

poverty;

7. Zero bad tenant, zero tolerance for rent tyrants, protect sacrosanct

private property;

8. Promote social inclusion, realize racial integration and equality, and

eliminate racial discrimination through policies regardless of race:

9. New York State builds 6,000 free public toilets opening 24 hours a day

(approximately one for every 3,000 people);

10. Unify tax rates, eliminate fiscal deficits, ensure fairness, and promote

development;

11. Control clutter and strengthen sanitation in urban communities. The

government is mainly responsible for sanitation in all public areas;

12. Anti-drugs and

eliminate the health problems, criminal behavior and social instability

caused by drugs

;

13. Banning guns.

With current military technology and weapons and equipment, guns in the

hands of civilians are basically useless in resisting the tyranny of

government troops and foreign troops. In the past four years, an average of

120 people have been killed by gunshots every day in the United States , and

the annual economic loss caused by shootings is US$557 billion;

14. Reasonably integrate welfare policies and strengthen welfare for the

elderly, disabled people and those who really need care;

15. Invest in and reasonably improve public transportation infrastructure;

16. Promote prosperity and strengthen education;

17. Promote economic growth – Support New York City’s high-tech businesses

and small and medium-sized businesses;

18. Foster entrepreneurship – create more free markets in New York;

19. Promote and strengthen international cooperation and exchanges, so that

most of the world's top 500 companies have branches in New York, and most of

the world's top 500 universities have branch campuses in New York;

20. Promote the abolition of tipping habits;

21. Improve the unreasonable parts of New York’s laws and regulations.

New York has entered a new era!

Brief description of the political platform issues:

1. Universal Basic Income (UBI)

:

1.1 Overview of Universal Basic Income:

Universal Basic

Income (UBI), universal free basic medical insurance, unconditionally

available to all New Yorkers, $33/day/person, from the day of birth to the

day of death, so that everyone has a basic income to ensure basic living

every day , there is not a single poor person below the poverty line in New

York.

Universal Basic Income, UBI, also known as Unconditional Basic Income, is an

unconditional direct payment to all New York people. Every New Yorker

receives this fixed amount regularly, regardless of whether they have a job,

income, or other conditions. The amount is based on the poverty line as the

main reference and takes into account the actual ability of the society.

This income provides people with basic economic security and stability and

meets their basic living needs. Every New Yorker has it, so that there will

be no person below the poverty line in New York, ensuring that every New

Yorker has enough money to meet their basic needs. The money of all New

Yorkers will be divided into two parts. The first is basic living needs,

which comes from the UBI distributed every day. It is the same for everyone.

The other is the additional part to meet basic living needs, because

individuals have different earning situations, and different. Human life is

divided into basic life and enjoyment life. The former is guaranteed by the

UBI, and the latter is earned by oneself. Basic medical care is the basic

guarantee for modern people's survival, and every New Yorker must have it.

"Federal Poverty Guidelines"

established by the government, referred to as FPG (or Federal Poverty Level

(FPL), is now about $1,000/month/person (the poverty line amount per person

decreases with the increase in family size and changes over time)

(https://www.dealmoon.com

/guide/981641).

FPL, calculated by the U.S. Department of Health and Human Services (HHS)

and adjusted annually for inflation and other factors, defines the minimum

income a person needs for food, clothing, transportation, shelter and other

necessities. The FPL can be used to determine eligibility for various

federal and state Social Security benefit assistance programs.

We plan to achieve a UBI of $33/day/person in New York, using this poverty

line as a reference standard to ensure that all New Yorkers have an income

no less than the poverty line without any conditional investigation or

restrictions. The money received from the UBI plan will be the same for

everyone, so that no New Yorker will be below the poverty line, achieving

zero poverty. According to New York's current economic and productivity

levels, UBI is completely feasible.

The UBI here is not a welfare provided by the government, not reducing the

gap between rich and poor, not protecting nor caring for a certain group,

and its main purpose is not to increase everyone’s average income and living

standards, but to protect everyone’s basic survival needs, completely

eliminate poverty. UBI is not egalitarianism. It is an independent social

security operation plan. After its implementation, it has solved most of the

problems in New York society, especially those related to poverty, and has

beneficially affected all aspects of society aspects, so that all aspects of

the problem have the basic conditions for a good solution, New York society

will be completely renewed, and New York can and needs to achieve it.

It’s so important that everyone in New York receives a basic income of

$33/day/person, unconditionally. If it is $ 1,000 /month/person, it can only

be started on the first day of the month, otherwise there is no guarantee

that it will be useful from the beginning of the month. However, after

giving out $ 1,000, someone may use it up in one day, and there will still

be no money to guarantee basic living for this month. So that it must be

$33/day/person. In the past, when electronic network technology was

underdeveloped and unavailable, it was impossible to allow each person to

receive $33 in cash every day. Thanks to the current high-tech electronic

network technology, $33 can be automatically transferred to everyone's

account through the Internet system, which is completely feasible in New

York currently.

1.2 Sources of funds for universal basic income:

New York State has a population of 20 million, an annual GDP of US$2

trillion, a per capita annual GDP of US$100,000, and a per capita personal

income of US$75,000 per year (US$6,250 per month) (

https://fred.stlouisfed.org/series/NYNGSP

,

https

://en.wikipedia.org/wiki/Economy_of_New_York_(state).

New York has the largest political and economic advantages in the world, and

the greatest development capabilities and potential. UBI and universal free

basic medical insurance can be achieved with New York's current

capabilities. New York's UBI will become an independent plan and will not

use other existing funds directly. However, after the implementation of UBI,

it will release huge energy for prosperity and development and save a lot of

money in other areas. New York will fundamentally change and enter a new era

!

1.3 Analysis

To make an analysis and metaphor based on the actual situation, if the

poverty line of a social community is $1,000 per person per month, half of

the people in the community have no income, and the other half of the people

have a monthly income of $2,000 per person. If all personal income is

collected, then give each person per $1,000 a month, the funds will be

balanced, but this is egalitarianism, and most people will be unwilling to

work. Anyway, they will get $1,000 a month whether they work or not, and

society will decline. But the current situation in New York is that the per

capita personal income is $6,250 per month. As an analogy, suppose half of

the people have no job and no income, and the other half of the people earn

$12,500 per month. From the half of the people who earn $12,500 per month

and $2,000 is collected per month. All New Yorkers are given $1,000 per

month per person. The amount of funds is balanced. People with no income

will receive a net $1,000 per month from the UBI, and their total income is

also $1,000 per month; those with a monthly income of $12,500 will

contribute $2,000 per month, and each person receives $1,000 per month from

the UBI. The net income for the monthly income $12,500 per person per month

is $11,500 ($12,500-$2,000+$1,000). Under such circumstances, the entire New

York funds are balanced and guaranteed. There are no people with a monthly

income of less than $1,000, which means there are no poor people living

below the poverty line in New York. At the same time, the actual monthly

income of a person who earns $12,500 per month is $11,500, which is

reasonable and acceptable. A person who actually earns $11,500 per month at

work will not stop working just as they can get $1,000, and it will not

affect people’s enthusiasm for work. On the contrary, it will stimulate

people to work harder and create more wealth (that is, for every $1 earned,

they will take home $0.84). A person who makes no money at all only gets

$1,000 per month from the UBI plan. With life insurance, the actual income

of a person who makes $100 a month is $1,084 per month. The actual income of

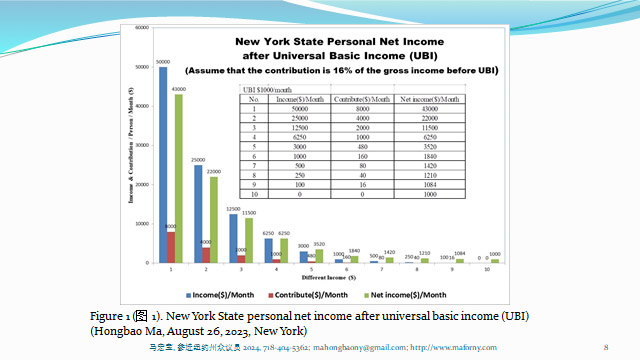

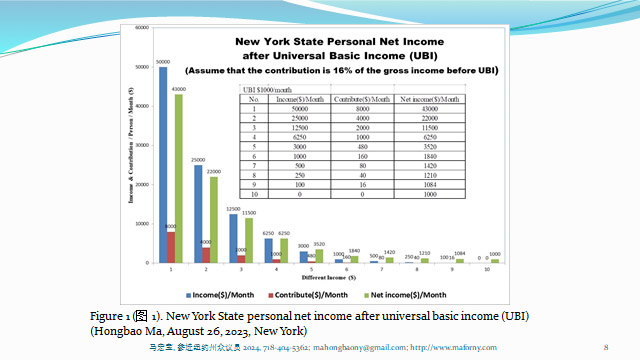

different income earners before and after UBI is shown in Figure 1, and New

York’s GDP is shown in Figure 2.

Figure 1. New York State personal net income after universal basic income

(UBI)

(Hongbao Ma, August 26, 2023, New York)

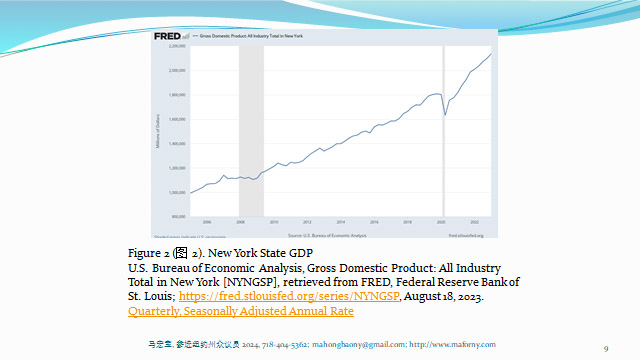

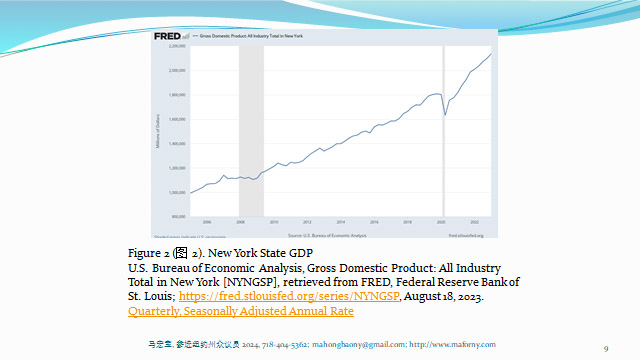

Figure 2. New York State GDP

US Bureau of Economic Analysis, Gross Domestic Product: All Industry Total

in New York [NYNGSP], retrieved from FRED, Federal Reserve Bank of St.

Louis;

https://fred.stlouisfed.org/series/NYNGSP

, August 18, 2023 .

Quarterly, Seasonally Adjusted Annual Rate

1.4 UBI has many benefits and has a great positive impact on society:

UBI reduces socioeconomic inequality and provides basic economic security,

fairness and equality of opportunity, allowing everyone to have the

opportunity to pursue their potential. Giving people a bottom line of

economic security can encourage people to boldly invest in entrepreneurship

and innovation, reducing or even eliminating worries about being unable to

live due to investment failure, because they are no longer completely

dependent on traditional salaried jobs. Compared with some social welfare

programs, UBI is simpler to operate, reducing a lot of administrative

overhead and complex eligibility checks. The most important issue in life is

basic survival guarantee, no matter who you are. Because everyone has an

unconditionally guaranteed basic income, UBI could provide for tax cuts in

other areas.

1.5 UBI provides better conditions for social development

:

If a basic income of 33 dollars per person per day is provided

unconditionally, people will not give up their jobs to earn more money, and

people's instinct to pursue unlimited wealth will not disappear because of

UBI, whether they are rich, ordinary people, or poor. Because of the

disappearance of poverty throughout New York, the entire society has been

fundamentally changed. Security is guaranteed, science, technology and

productivity are further developed, new wealth is created in greater

quantities, various resources are comprehensively and rationally integrated,

and the overall development of society is improved. At the same time, New

York has the greatest political and economic advantages in the world and the

greatest development potential. Under the guarantee of UBI, concerns about

modern technology, including artificial intelligence, replacing people's job

opportunities are eliminated, giving social development a greater impetus.

UBI allows more people to be willing to do volunteer or low-cost work.

1.6 Social affects, efficiency and fairness:

Under the current social welfare system, no matter how the rich or poor is

excluded, no matter what the asset review system is, there will always be

problems with the subsidy threshold and the poverty trap effect, or many

people do not know how to apply for subsidies, or the process is too

complicated, or they do not know whether they are eligible. Eligibility, or

unwillingness to apply for poverty subsidies out of personal reasons, or

allowing those who do not need or are not eligible to receive subsidies, so

that those who really need cannot receive assistance, thus leading to

welfare fraud, administrative bureaucracy, corruption and waste of

resources, questions, etc. Funded groups may also be labeled, discriminated

against and questioned. For UBI all aspects are valid, reasonable and

realistic. UBI is a social operation that is directly related to money. It

is a matter of actual operation of the whole society when necessary, and is

not suitable for local experiments. For example, if each of 100 people is

given a certain amount of money (such as $1,000 per month), it is impossible

to draw conclusions about the impact on the work desire, life attitude and

happiness of the people who receive the money. It is assumed that these 100

people and other people around them are at the same time. In a community

society, a monthly payment of $1,000 is similar to a stock going up by

$1,000 or an extra $1,000 for some reason. In reality, life is still in the

original community society. However, only when a large enough community

implements UBI, and almost all aspects of the community's security, industry

and commerce, employment, education, housing, government operations, etc.

are completely positively affected, and the real social effects of UBI can

be obtained. Of course, the best community size for UBI is a country, the

entire United States, but due to the complexity of the problem, starting

with New York State, such a community is already large enough to implement

is the best way and the best for beginning. At the same time, New York’s

current conditions and development potential in all aspects are most

suitable for implementing UBI first.

1.7 There are more reasons to implement UBI:

The reason why UBI is needed is also that New York’s main resources are

shared by New Yorkers, such as rivers, sunshine, air, natural resources,

seawater, and public expenses incurred by people, such as sewage, should be

borne jointly. With the current strong productivity, it is necessary and

achievable to ensure that every New Yorker has a basic income to ensure

basic living, using New York’s resources, and New York has the ability to

manage the UBI. Since ancient times, universal payment has always existed.

For example, for the use of public facilities and roads, the government

spends money, but users do not pay.

1797 Thomas Paine said: "The earth was not made by man. Individual property

is only the value of improvements, not of the earth itself. Every owner is

liable to the community for the rent of the land he owns." Paine viewed

inheritance as a common fund part, and hoped to supplement the citizen

dividend with an estate transfer tax (In 1797 Thomas Paine stated that "Men

did not make the earth. It is the value of the improvements only, and not

the earth itself, that is individual property. Every

proprietor owes to the community a ground rent for the land which he holds."

Paine saw inheritance as being partly a common fund and wanted to supplement

the citizen's dividend in a tax on inheritance transfers

(https://en.wikipedia.org/wiki/

Universal_basic_income).

As early as 46 BC, the ancient Roman consul Julius Caesar (Gaius Julius

Caesar) began to provide living expenses to all Roman citizens. 1516 British

philosopher-statesman Thomas More formally proposed basic income Guaranteed

basic income, there have been a lot of attempts around the world. Finland

launched the UBI experiment in 2017, transforming it from an idea into a

policy at the national level for the first time (2,000 unemployed people

were randomly selected and paid 560 euros per month for two years); in the

2020 U.S. presidential election, Andrew Yang made UBI as a core part of his

political platform.

1.8 The most thorough way to fundamentally solve the current problem

:

UBI is the most effective and thorough way for New York to fundamentally

solve the current problems. It is the best choice and the most beneficial to

the people and society. Moreover, New York is now fully capable and can

implement it. New York will be the first to realize UBI, and then it will be

implemented in surrounding areas, including New Jersey, Connecticut,

Pennsylvania, Rhode Island, Massachusetts, etc., and finally the entire

United States will realize UBI, until the whole world will realize UBI and

completely eliminate poverty which also benefit for the global peace target.

In fact, in actual situations, New York’s per capita income is $ 6250

/month/person and New York’s specific various welfare payments mean that

theoretically there are no people below the poverty line in the state. The

existence of people below the poverty line is only due to the management

system and the application process was flawed. After UBI, fewer funds will

achieve zero poverty in New York.

The fundamental reason and purpose of implementing UBI are to ensure that

the economic status of everyone in New York is above the poverty line and to

ensure everyone's basic life. Its implementation is affected by AI, etc.,

but AI is not the direct cause .

1.9 Another analysis of UBI funding:

The poor and low-income people in New York now receive various welfare

subsidies from the government, many of which exceed US$1,000 per month. For

the non-poor but the ordinary class (for example, the per capita income is

about $6,250), even if US$1,000 is collected and US$1,000 is sent back, the

government’s expenditures will not increase and the personal income will not

decrease. If a basic income of $33 per person per day is provided

unconditionally, people will not give up jobs that earn more money. Because

of the disappearance of poverty throughout New York, the entire society has

been fundamentally changed. Security is guaranteed, science, technology and

productivity have developed further, new wealth has been created in greater

quantities, various resources have been comprehensively and rationally

integrated, and the overall development of society has improved. New York

has the world's largest political and economic advantages and the greatest

development potential. With UBI and universal free basic medical insurance,

New York can achieve this with its current capabilities.

2. Zero poverty (poverty elimination)

:

The poverty line in the United States is approximately $33/day/person, and

UBI is paid to each person at $33/day which completely eliminates the

poverty. With UBI, there will be no people below the poverty line in New

York, which will make it possible to eliminate all problems caused by

poverty, including crime, theft, money owed, vagrants, homelessness,

psychological and mental illness, etc. caused by poverty. In 2021, New York

City's updated poverty line based on inflation is: $13,788 for one person

and $27,740 for a family of four ($6935/person). One person needs

approximately $1149 per month and a family of four needs $577 per person per

month. By implementing a UBI of $33 per person per day ($990/month/person)

and encouraging families to live together, zero poverty has been achieved.

From then on, there are no poor people or low-income people in New York!

Regardless of single life or family life, UBI is paid on a per-person basis.

The larger the family size, the lower the per capita basic living expenses,

but the per capita UBI is the same. This also encourages family life,

promotes social stability and improves the happiness index. At the same time

it also avoids the trouble and injustice caused by the calculation of family

size in UBI distribution, and reflects the principle of equality for

everyone.

According to a 2017 report released by New York University's Furman Research

Center, New York City's poverty rate has been higher than the national

average since the 1980s, remaining between

19% and 21%.

Data between 2011 and 2015 show that 1.7 million people of New York City 8

million people are below the poverty line.

The Asian American Federation (AAF) released six racial profiles of Asian

Americans in New York City, including population growth, income,

homeownership and education levels. In this racial profile of Asians

released by the Asian American Alliance, Asians include Chinese, Indian,

Korean, Japanese, Filipino and Vietnamese, etc., and shows the demographic

data of different Asian ethnic groups in New York City and related important

analyses, covering population growth, neighborhood concentration, age,

immigration and citizenship status, education, English speaking proficiency,

poverty, income, welfare and health insurance coverage, employment, housing,

computer and Internet use, and other key demographic and community economic

data. According to this overview, New York City has a population of 1.5

million Asians, accounting for more than 17% of the total population of New

York. From 2015 to 2020, the Asian population increased by 6.8%, while the

total population of New York City decreased by 0.8%, growing faster than

other ethnic groups. In addition, compared with other Asian ethnic groups,

Chinese Americans account for the highest proportion of poor people,

accounting for 39.8%. Japanese families have the highest computer ownership

rate (97.9%) and Internet access rate (96.2%) among Asian families.

Filipinos have the highest proportion of bachelor's degree holders among

Asians, accounting for 49.4%. Koreans have the highest uninsured rate,

accounting for 9.7% of Asians (http://www.chinaqw.com/hqhr/2022/09-09/340206.shtml).

According to data from the U.S. Census Bureau, the number of poor people in

the United States reached 46.2 million in 2010, and the poverty rate was as

high as 15.1%, the highest in 52 years. The poverty rate in 2020 reached

11.4%, an increase of 0.9 percentage points from 10.5% in 2019. Currently,

37 million people in the United States still

live below the poverty line .

Eliminating all forms of poverty is an important goal of the United Nations'

sustainable development. The fundamental purpose of development is the

common prosperity of the people, which should become the consensus and

action of all countries.

3. Zero crime (zero tolerance crime, eliminate crime caused by poverty):

According to the New York Post, there will be a surge in major crime cases

in New York City in 2022, with the major crime rate hitting a 15-year

record. Data released by the New York Police show that a total of

approximately 172,000 felony cases were reported in New York City in 2022,

an increase of 20.4% from 143,000 in 2021. Felony cases mainly include

criminal damage, criminal contempt, murder and possession of a dangerous

weapon.

Many seemingly minor crimes are often a precursor to more serious crimes,

and trespassing is always a precursor to a burglary, which can quickly turn

into a robbery, and then quickly into an assault. Misdemeanor assault turned

into felony assault.

When people receive basic necessities, financial and medical security, and

economic development opportunities through measures such as UBI and other

social support policies, the conditions for eradicating crime are given, or

at least the reasons that drive individuals to engage in criminal activities

are basically zeroed out. Once poverty is eliminated, it has a knock-on

effect in eliminating crime. Addressing the root causes of crime such as

basic living needs, systemic inequalities, lack of education and social

marginalization will achieve the goal of zero crime after zero poverty. At

least from the legal point, it will be zero tolerance crime in the whole New

York State. This can be achieved simultaneously through a holistic approach

involving community engagement, law enforcement reform and evidence-based

crime prevention strategies, applying today's high-tech achievements to

address underlying social, economic and systemic problems. If crime is bad,

the New York government must work hard to eliminate crime and eliminate bad

things without reservation.

4. Zero homelessness (eliminating homelessness caused by poverty):

New Yorkers, once everyone has a basic income, they can ensure basic

clothing, food, housing and transportation, and eliminate the basic reasons

for living on the streets. If the government strengthens management on this

basis, it can completely eliminate the existence of homeless people and

completely cancel the homeless population.

New York's shelter population has now surged to nearly 100,000, doubling in

size since last year, and has quickly evolved into a humanitarian and

financial crisis. According to the New York Times and New York Post, by

August 2023,there

will be 100,000 People are housed in shelters run by the New York City

government. The population is roughly the same size as in Albany of New York

State. About half of the

homeless people,

or 50,000, are asylum seekers. The New York City government arranged to use

hotels to house homeless people, resulting in a huge burden on taxpayers. It

costs the New York City government about $ 385 per night to house a homeless

and immigrant family in a shelter, which means the asylum seeker crisis is

costing taxpayers about $ 7.9 million a day. Emergency Management Director

Zach Iscol said the city is using 10 hotels in West Virginia and upstate to

deal with the influx of migrants. He pointed out that as the crisis

intensified, the city government had used or identified 1,000 shelter and

resettlement sites. It must be a good management for this problem.

5. Zero unemployment, abolish the minimum wage and achieve zero unemployment:

5.1 After universal basic income is realized, there will be no need for a

minimum wage

The main rationale for a minimum wage is to ensure that a job is sufficient

to cover basic living expenses. With the implementation of UBI, a minimum

wage is no longer needed to guarantee basic living expenses. Complete

liberalization and marketization of wages will ensure that everyone has a

job that suits them, and is not determined by the salary amount. This will

allow people to be more proactive and effective in doing jobs and things

that suit them, and at the same time, society can adjust production costs at

any time and efficiency, giving New York a very strong driving force for

development, producing more cheap and high-quality products, and providing

high-quality goods and services at competitive prices, benefiting all of New

York, selling to and benefiting the world, embracing complete marketization

and guarantee a job for everyone. With a UBI that guarantees life for New

Yorkers, everyone can better engage in jobs and careers they really like,

and prevent people from doing jobs they are unwilling to do or are not

suitable for in order to earn enough money to maintain their basic lives

own. The minimum wage is a need, a survival need in a society with certain

living and consumer prices, not power, and not necessary after UBI.

5.2 The abolition of the minimum wage is in line with the current social

reality

Minimum wage laws are essentially inconsistent with labor marketization.

Whether you are self-employed or employed, you spend time working and earn

corresponding income. The source of income comes from the new wealth and

value created by work, not the labor itself. For example, if a person

purchases raw materials and other costs for $50, and after one hour of work,

the product is sold for $70, that is, he earns $20 an hour. If he is

self-employed, he earns $20 an hour. If he is employed, the employer earns

$5, and the employee earns $15, the balance meets the minimum hourly wage of

$15, no problem. However, if a person spends $50 to purchase raw materials

and other costs, and after one hour of work, the product is sold for $60.

The total income for this hour is $10. Even if it is all given to the

worker, the income of $10 per hour is lower than the legal limit of

$15/hour. It is illegal, and the work itself has become illegal. In this

way, firstly, it deprives the person’s labor rights who work every hour to

create new wealth below the minimum hourly wage (labor is a natural human

right); secondly, it creates the unemployed population; thirdly, it causes

social waste; fourthly, it raises social costs, which is harmful to the

society. It is detrimental to people's happiness in life and the prosperity

and development of society.

As a commodity, the price of labor is wages, that is: monthly salary/annual

wages/hourly wages/piece wages, etc. Setting a minimum wage is essentially

an act of government price control. It

is a wrong regulation and is not a market economy. The

minimum wage law is also an unreasonable regulation.

To give a simple example, one makes a video and put it online to earn

Internet traffic income. As an income, it is no problem for one to earn 1

dollar an hour who put video online to make money. Many people like it, and

it is possible to make a lot of money after a certain period of time. At the

same time, it can also be used to develop these tasks, people employ

employees at any reasonable and acceptable salary, New Yorkers have been

completely liberated, generating unlimited energy to develop productivity

and improve happiness. New York's prosperity and development have increased

by orders of magnitude, and the happiness index of New Yorkers has also

increased by orders of magnitude improve! When there is a minimum salary

control, one earns money throw Internet activity will be illegal if the

income lower than minimum salary, which will deprive the human right for

someone whose ability can only make money lower than the minimum amount.

Another point is that many jobs in the past were arduous labor, such as

construction, brick moving, mining, production line production, etc., that

maybe not good for someone’s income is too low. If the wages are too low,

there will be humane issues. Nowadays, with the development of science and

technology, the improvement of productivity and the progress of society,

many jobs are no longer heavy physical labor, such as making videos, singing

and dancing, cultural exchange services, e-commerce, etc., please like to do

even not big income, which does not need minimum wages. With the guarantee

of UBI, no matter how low the salary is, it’s no longer a problem. At the

same time, owners eliminate or reduce worries about violating labor laws and

losing money, and employees increase their enthusiasm to start businesses

and become business owners. No matter how little money everyone makes, it is

still a job that is better than no work to do. Also, when not doing any

work, one can take courses and study. New York has achieved zero

unemployment!

5.3 Here is some further discussion:

5.3.1.

The essence of the minimum wage law is, first of all, to infringe on labor

rights and violate the law of fairness. Labor power itself is a commodity,

fully owned by the workers themselves. As long as they are not deceived or

forced, workers themselves, as human beings, have full rights to determine

the selling price of their labor. However, the so-called minimum wage law

stipulates the price at which workers sell their labor in the form of law,

conducts price controls and

price monopoly,

and

deprives workers of their natural human right to decide on the sale of their

own labor.

It is unreasonable for people to even have the selling price of their own

labor determined by legislators.

5.3.2.

On the surface, the minimum wage law protects workers from receiving the

minimum wage, but in fact it deprives some workers of job opportunities.

Assuming that the minimum wage is $15 per hour, if a person cannot find or

has the ability to complete a job of $15 per hour, and is limited by ability

or opportunity conditions, he can work for a certain company but can only

create $14 of value per hour, what should this company owner do? Let him

work for this company but pay him legally $15 an hour? Thus, for every hour

he works for the company, the company loses $1. The company obviously cannot

engage in such loss-making operations. If the company lets him work but pays

him $14 an hour, even if the company does not make a penny, it is still

violating labor laws. In this way, the company had no choice but not to hire

him for work. The first result was that the worker was deprived of work

rights and opportunities by the minimum wage law. While it may be good for

other workers that he can't work (competition), for him even making $14 an

hour is certainly better than not working at all. Moreover, working to make

money is only part of the purpose of work. When a person has the opportunity

to perform a job, it also gives him the opportunity to participate in

society, obtain new learning and training, get fun at work, etc. Since there

are people in the labor market who are willing to work for lower wages, then

the so-called minimum wage is not unbearably low for that person. If no one

in the social market is willing to work for a lower wage, then there is no

need to set the minimum wage as a lower limit. As long as there is an

unemployed person in society, there should be no minimum wage law, otherwise

it will be unfair to the unemployed person.

5.3.3.

Minimum wage laws restrict the working rights and opportunities of some

people, and accordingly limit the amount of social wealth created. If a

person's abilities and opportunities are limited so that he cannot create

value higher than the so-called minimum wage, he has no right to work

according to the minimum wage law. However, if he cannot be killed, he still

has to consume social wealth to survive. Under such circumstances, of

course, it is better to let him do the work what he can do, rather than

setting a minimum wage law that makes it illegal for him to work. As long as

there is no deception or coercion, the level of wages should be completely

negotiated between the buyer and seller of labor services, rather than price

controls.

5.3.4.

Minimum wage laws harm the development of a country or region. You may

stipulate minimum wages in one country or region, but you cannot require

other countries and regions to make the same legal provisions. Especially in

the current globalization situation, stipulating higher minimum wages will

naturally increase production costs and make products more competitive low.

It is not surprising that many companies in the United States have moved to

China, India, Mexico, and Southeast Asia for production. The result was an

economic recession in New York.

5.3.5.

On the surface, the minimum wage law is said to protect the interests of

workers, but in fact it harms the interests of the parties involved. The

minimum wage law, which is enacted claiming to help the poor, will not only

be ineffective in alleviating poverty, and the minimum wage regulations will

also cause market discrimination. The reduction in labor demand leads to an

increase in the number of unemployed people. Because after the

implementation of minimum wage regulations, the cost of hiring labor for

enterprises has increased, and the motive of profit maximization has driven

enterprises to lay off employees. At this time, some so-called disadvantaged

workers with lower abilities have been fired, leading to the deterioration

of the employment situation of the labor force.

5.3.6.

The minimum wage law is not a manifestation of modern human civilization,

but has its roots in ancient times. Since human beings began to exchange

commodities, because of human nature, there is a desire or requirement that

the price of other people's similar commodities should not be higher than

one's own desire, so that one's own things can be sold easily. There are

some rogue market tyrants and scoundrels in the market, who may run rampant

on a few streets and sell cabbage for two dollars a pound, but they do not

allow others to sell cabbage for one dollar and a half. If someone sells for

a lower price than some people, they will find a few hooligans to destroy

the stall. They even beat sellers and buyers, but when the police came, they

still couldn't find who had smashed the stall. The so-called minimum wage

law rises to the level of a law, stipulating that one's own labor can be

sold for $15 per hour, but other people's labor cannot be sold for $14 per

hour. Otherwise, both the buyer and the seller will be arrested and sued for

violating the minimum wage law. Therefore, it can be seen that the minimum

wage law uses legal means to bully the market and de-market labor prices.

5.3.7.

Minimum wage laws are a tool used by politicians to curry favor with

existing workers.

Public policy is the product of competition among various social forces, and

its essence is the adjustment of the social interest pattern. Politicians

use the distribution of social benefits to serve their own votes.

The following statement is very true: If I am reduced to begging, then you

should not prohibit me from begging, it will only hurt me further. If I

shine people's shoes, please don't impose a minimum wage beyond my means. If

you love me, protect my right to the best life possible - to shine shoes,

and my customers' right to pay the cheapest price for a service - to have

their shoes shined.

The minimum wage laws in the United States are as follows for reference:

In 1938, the U.S. Congress passed the Fair Labor Standards Act, which

clearly stipulated that the minimum wage standard was 25 cents per hour,

marking the entry of the minimum wage issue into the legislative field of

the U.S. federal government. As time goes by, the coverage of the minimum

wage standard continues to expand, and the minimum wage standard continues

to increase over time. In 1990, Congress passed a bill setting the minimum

wage at $4.25 per hour. In 1996, it raised the minimum wage to $5.15 per

hour. Until January 10, 2007, the U.S. House of Representatives and the

Senate passed a bill to increase the minimum wage from $5.15 an hour to

$7.25 an hour. In the United States, in addition to the federal minimum wage

standards, many states and cities also set their own minimum wage standards,

but they cannot be lower than the federal standards. Currently, more than 20

states in the United States have minimum wage levels higher than the federal

standard. The law on minimum wage standards also stipulates that overtime

pay is 1.5 times the normal wage.

6. Zero dollar arrears (eliminating poverty as a reason for not paying dues)

:

Once everyone in New York has a basic income, there will be no reason to

exist, such as zero-dollar purchases, rent arrears, no money for meals, no

tickets for taking trains and buses, etc.

7. Zero-rent tycoon protects sacrosanct private property

:

Anti-rental tyrants (bad tenants who refuse to pay rent), strictly abide by

the spirit of the contract, adhere to the basic rules of human society that

rent a house to live in with paying rent, something like paying for food and

air tickets, etc., and cancel the housing court to protect private property

totally. The sanctity of the contract and the integrity of the contract

guarantee the private property ownership of houses in New York. Pay

attention to and protect the inviolability of private property rights and

ensure strict compliance with contract agreements. Zero tolerance for bad

tenants (rental bullies) at least by laws, promote a responsible and

rule-respecting community, respect and maintain private ownership, and

promote the opportunity for every New Yorker to own real estate. Many people

are both landlords and tenants, and it is convenient and free to move and

change residences. Fully improve the living convenience, work convenience

and transportation convenience related to residence, and greatly improve the

quality of life and happiness of New Yorkers. With the goal of providing

adequate housing space per capita and maintaining high quality standards,

New York is a global leader in housing accessibility and quality.

Real estate is private property, and renting a house is a matter of course.

New York has a long-term tendency to favor some tenants in refusing to pay

rent, and has even created a serious problem of rent hegemony, which is

contrary to private ownership's protection of private property from

infringement and violates the spirit of the contract. New York unilaterally

emphasizes and protects the tenants' willingness and interests not to pay

rent, regardless of the landlord's tax, mortgage, water, electricity,

maintenance, economic hardship, and infringement of private property rights,

etc. The expenses incurred by tenants who do not pay rent for using the

house are actually paid by the landlord. To allow tenants not to pay rent is

essentially to let some people pay for the living expenses of others, which

violates social fairness, basic rights of the people, public interests and

private interests. The basic norms of the social system of property

inviolability, while at the same time disrupting and harming the housing

market and social development, and damaging social civilization.

rent tyrants is a simple money problem. Renting a house and paying rent is

similar in nature to paying for meals in restaurants and paying for shopping

in stores. People cannot say that who can eat in a restaurant without paying

if they are hungry and have no money to but the food. People cannot say that

they can go to the store if you need something but have no money, taking

things without paying. Food, clothing, housing and transportation are basic

necessities, but they must be paid for. This is the bottom line of

civilization that mankind has adhered to for thousands of years. Otherwise,

we would not be in human society. Requiring rent and dealing with

non-payment of rent is like dealing with non-payment for meals in

restaurants and non-payment of goods in stores. It should be the job of the

police first, not the task of the courts. If a lawsuit goes to court over a

dispute over certain rent amounts, etc., according to normal procedures,

arguing the rent amount between landlords and tenants can go to the small

claims economic court. Normal procedures require one appearance in court to

explain the case. Normally, even for an eviction case, it is not good to

take long time. If it takes too long, there should be a problem with the

court's work, and the judge should be held accountable for the problem.

Housing is a big deal and the problem is serious. Real estate is the largest

private property among most residents, and housing is the largest living

expense for most people. To require some people to pay for the housing and

living expenses of others for a long time is to break the basic bottom line

of human social civilization. At the same time, this situation in New York

makes many people not pay rent, which seriously affects the maintenance of

houses, normal buying and selling of houses, renting and living, destroys

the real estate market, reduces the supply of houses, hinders social and

economic development, encourages getting something for nothing, and lowers

the level of social civilization and morality. Normal tenants are also

victims. The essence is not only a dispute between landlords and tenants,

but also a civilized dispute between people. It is completely wrong to

repeatedly extend the non-payment of rent. We hope that people with a sense

of justice and support for social morality will protect the private system

and the sanctity of private property from being infringed, so that New York

society can exist and develop normally! Those who support rent bullies not

paying rent are all accomplices in rent robbery, just like those who support

not paying for meals in restaurants and not paying for things in stores.

Moreover, the amount of rent robbed by rent tyrants is often many, many

times greater than the money that food tyrants and shop tyrants do not pay

for meals in restaurants and goods taken from stores. The severity of a

crime is legally determined to be directly related to the amount of money

involved. In many cases, the seriousness of a crime is determined to a

certain extent by the amount of money involved. Robbery is an anti-human

criminal behavior that cannot be tolerated in any normal society, zero

tolerance!

Protection of private property is the cornerstone of human civilization, the

foundation of a country, and of course the foundation of the United States.

From ancient times to the present, no society has been able to move forward

without protecting private property. The politics of attacking homeowners

and protecting renters undermines the very foundation of American

civilization.

The more fundamental way to solve the problem of rent hegemony is to

formulate laws and regulations to stipulate three points. First, one must

pay the rent when renting a house, just like the money you pay for eating in

a restaurant; second, cancel the housing court, and not paying rent when

renting a house is the same as for some people don't pay for a meal in a

restaurant. One will be treated the same as if he/she takes goods in a store

without paying. There is no need for a restaurant court or a housing court.

Thirdly, if people don't pay the rent, they will be treated the same as if

they stay for more than 30 days and less than 30 days. The unpaid rent means

that the amount of money has not been paid, and it has nothing to do with

the number of days one has lived there.

Regarding the issue of rent bullies in New York not paying rent, state

legislators should draft correct laws to protect private property. This is 100% reasonable. There are currently 150 members

of the New York State Assemblies and 63 senators. Even if one member proposes a law that

completely protects private property, the correct thing is that the other

149 members unanimously agree, because protecting private property is a

basic value of society and the foundation of the United States. Even if

people who are free to eat and live for free really need it, it is not

allowed. Owning and accumulating private property wealth, including real

estate, is the most important thing in human society from ancient times to

the present for most people, and is the cornerstone of the existence and

development of human civilization.

"Life, liberty, and the pursuit of happiness" stated in the United States'

Declaration of Independence is the essence of American values. Among the

many rights inherent in the people, private property rights are protected by

the state. The Fifth Amendment to the U.S. Constitution states: "No one

shall be deprived of life, liberty, or property without due process of law;

the private property of the people shall not be taken for public use without

reasonable compensation." The Constitution is the supreme law of a country.

This is not just a matter of the economic interests of some landlords, but

more importantly, it shows whether the United States is a civilized society

that respects the spirit of contract and protects private property, or

whether it makes the United States an anti-civilized society that ignores

the spirit of contract and ignores the protection of private property.

8. Achieve racial equality

:

Promote inclusivity, racial integration and equality and eliminate racial

discrimination through policies regardless of race: government affairs and

statistics, recruitment, admissions, industrial and commercial operations,

welfare payment and general legal cases, etc., do not set up racial identity

columns, and do not make racial distinctions. People of all races are

treated equally and all are New Yorkers. Eliminating racial identity

promotes inclusion and equity, thereby reducing discrimination and ensuring

equality. Treat all races equally and adhere to the principle of “We the

People”, so that New York can truly treat all races equally, become the most

substantial racial equality and the most cohesive and harmonious society. In

a society where individuals contribute based on their abilities and are not

evaluated on the basis of their race or ethnicity, New York becomes a more

inclusive and equitable society in which discrimination, prejudice, and

inequalities based on race are eliminated will be minimized, thereby

promoting and ensuring social cohesion and fairness, racial equality and

integration, prosperity and happiness in life , and everyone is created

equal !

9. Free 24/7 public toilets (Free public toilets opening 24 hours per day

for 7 days per week, all days):

Going to the toilet is a basic need for all humans. New York City is in dire

need of and must have enough 24-hour free public restrooms to ensure New

Yorkers' toileting and sanitation, increase convenience and accessibility,

improve livability and quality of life, ensure health, improve public

safety, and promote New Yorkers' of health. At the same time, the use of

clean and well-maintained public restrooms can make cities more welcoming,

meet diverse needs, and help improve the overall satisfaction of residents

and visitors. All government-owned or government-controlled toilets for

public use are immediately available as 24/7 free public toilets. There is

at least one 24/7 free public restroom at every subway station or within

half a mile of a subway station. Ensure that New York State has at least

6,000 free public toilets open 24 hours a day (20 million people in New York

State, one public toilet for every 3,000 people). If the existing ones are

not enough, build the new ones to at least 6,000 in New York State. If it

costs US$100,000 to build a toilet, 6,000 toilets will cost a total of

US$600 million. To solve the major problem of people's toilet needs, the

investment of US$600 million in New York is a very small amount.

10. Unify tax rates and eliminate fiscal deficits:

Personal income tax and corporate profit tax are subject to a unified tax

rate. If you earn more and pay less, the tax is only calculated according to

the tax rate. The tax rate does not increase when more you earn. You only

pay tax according to the tax rate when you make money, just like you pay

retail tax when buying things in a store. A flat tax rate will greatly

stimulate people to work and operate harder, and at the same time, it can

improve fairness, social efficiency and government efficiency, leading to

more efficient allocation of resources, simplifying government processes,

reducing bureaucracy and strengthening the accountability of public

expenditures. A unified tax rate can simplify the tax system, reduce

administrative costs, stimulate economic growth by creating a more

predictable and stable business environment, significantly improve social

efficiency, especially people's work motivation and efficiency, thereby

promoting economic growth while improving New York's High-tech enterprises,

small and medium-sized enterprises and education, increase government

revenue and eliminate fiscal deficits. The most harmful thing is that due to

different tax rates and other reasons, for example, when the income is high,

the tax rate increases, resulting in more total income, but the net income

may decrease, which harms people's motivation to work hard and increase

their income.

11. Strengthen sanitation and cleaning in urban communities

:

The government is fully responsible for the cleanliness of public area and

the safety of public places, such as timely street sweeping and snow

removal, to eliminate messes in all places in New York. The government

sanitation and cleaning department uses sufficient cleaners and modern

cleaning tools to carry out timely and adequate cleaning of all places and

corners. Especially in crowded places such as Time Square and Flushing

Center, timely cleaning is required. During sanitation and cleaning, stores

and residents are encouraged to clean their doorsteps, but they are not

required to do so. The responsibility for cleaning lies with the government.

The sanitary cleaning of all public property areas outside private

properties, such as outside homes and shops, sidewalks, roads,

intersections, etc., is entirely the responsibility of the government

environmental sanitary department. Furthermore, when it snows in winter, the

government environmental sanitation department is also responsible for snow

clearing in public property areas outside private properties, such as

sidewalks and roads. Thanks to modern technology, including artificial

intelligence, the government is more capable and efficient in cleaning up

more effectively, which has also reduced a lot of burdens and troubles for

New Yorkers.

12. Anti-drugs:

Prevent, combat and further prohibit the production, trafficking and use of

drugs whose abuse is proven to pose serious threats to personal and social

health and lead to addiction, eliminate the health problems, criminal

behavior and social instability caused by drugs, and eliminate the impact of

opium,

Heroin, methamphetamine (methamphetamine), morphine, marijuana, cocaine, and

other narcotic drugs and psychotropic drugs that can cause human addiction,

the cultivation of original medicinal plants for narcotic drugs is

controlled. It is prohibited to illegally grow opium poppies, coca plants,

cannabis plants, and other raw plants controlled by the state that can be

used to refine and process drugs. It is prohibited to smuggle or illegally

trade, transport, carry, and possess uninactivated raw drug plant seeds or

seedlings. .

13. Gun ban:

There are several important reasons why the United States supports private

ownership of guns: 1) Constitutional rights: The Second Amendment to the

United States Constitution, passed on December 15, 1791, stipulates the

right of citizens to keep and bear arms to safeguard freedom and national

security. The amendment is considered an important means to ensure that

citizens can defend themselves against any threat from the government or

individuals. 2) Fight against tyrannical government: Owning weapons is a

means for citizens to fight against possible tyranny when needed, and

retaining the right of individuals to own firearms helps ensure that the

government does not over-centralize or abuse its power. 3) The right to

self-defense: Owning a firearm helps individuals protect themselves, their

families, and their property from crime and violence. 4) Crime: Allowing

legal gun ownership can increase the risk of criminals committing crimes

because they cannot determine whether a potential victim is armed. 5)

Cultural tradition: In the history of the American West and the struggle for

independence, the cultural tradition of individuals owning and using guns is

profound. 6) Hunting and Recreation: Firearms are used in the United States

for hunting and recreational shooting activities. Many people enjoy outdoor

activities such as hunting and shooting sports, which are considered a form

of recreation and cultural activity.

13.1 The reasons for owning guns are not suitable for today

The above main reasons for owning guns, except for the last point 6, hunting

and entertainment, are no longer suitable for the current social reality.

For example, the keeping and bearing of arms by citizens preserves liberty

and national security and ensures that citizens can defend themselves

against any threat from government or foreign forces, which was appropriate

at the time the Second Amendment was enacted, when civilians owned and

carried arms, but not now. The weapons are basically equivalent to the

weapons of the national government / military / police and normal civilians,

and the normal civilians could play a role in maintaining national security,

self-defense, and protecting oneself from threats from the government or

enemy forces in that time. However, in the current reality of military

technology and weapons and equipment, guns in the hands of civilians are

extremely harmful to shooting civilians and are basically useless in

resisting the tyranny of government troops and foreign troops (government

troop’s weapons and other countries’ military troops’ weapons are too

powerful than normal civilians’ weapons, too big different. (https://www.fmprc.gov.cn/web/wjbxw_new/202302/t20230216_11025872.shtml).

13.2 Shootings in the United States caused huge losses of life and property

There are approximately 400 million guns in the United States. From 2018 to

2021, an average of 120 people were killed by gunshots in the United States

every day, an average of 43,475 people were killed by gunshots every year,

and the average annual economic loss caused by gunshots was approximately

US$557 billion (https://time.com/6217348/gun-violence-economic-costs-us).

The United States' annual military expenditure is approximately US$800

billion, and the world's annual military expenditure is approximately US$2.2

trillion. The annual economic losses caused by shootings in the United

States are equivalent to 70% of the United States' annual military

expenditures and 27% of the world's annual military expenditures. In view of

the serious losses of people's lives and property caused by private guns and

serious social security problems, self-defense, culture, and entertainment

are not as important as the safety of life and property. Private gun

ownership causes civilians to hurt each other, which is unnecessary,

especially in a big city like New York City. The law needs to be revised

according to the actual situation of society, and now we should start to

face up to and discuss the issue of gun ban.

13.3 Countries in the world that have legally banned guns include:

China (including mainland China, Hong Kong, Macau), Japan, South Korea,

Singapore, Cyprus, United Arab Emirates, Iran, Bahrain, Brunei, Cyprus,

Qatar, Austria, Czech Republic, Greece, Poland, Andorra, Ireland, Sweden,

Portugal, Spain, Luxembourg, Belgium, Slodek, Estonia, San Marino, Slovenia,

Liechtenstein, Malta, New Zealand, Egypt, Algeria, Libya, Australia, and

Barbados, etc., which have no direct relationship with the socio-political

and economic conditions (https://zh.wikipedia.org/zh-hans/%E6%A7%8D%E6%9E%9D%E7%AE%A1%E5%88%B6).

13.4

Only nine countries in the world have written the right to bear arms into

their constitutions:

Only nine countries in the world had written the right to bear arms into

their constitutions: the United States, Bolivia, Costa Rica, Colombia,

Honduras, Nicaragua, Liberia, Guatemala, and Mexico. Now, only these three

countries have written the protection of the right to bear arms into their

constitutions:

The United States, Mexico, and Guatemala are

the only three countries that protect the right to keep and bear arms in

their constitutions. (https://www.jiemian.com/article/1727547.html).

13.5

The United States is the country with the largest number of privately owned

guns in the world:

The U.S. population accounts for less than 5% of the world's population, but

private gun ownership accounts for 46% of the world's population. According

to the Swiss Small Arms Survey, the number of privately owned guns worldwide

increased from 650 million in 2006 to 857 million in 2017, which is largely

due to the sharp increase in private gun ownership in the United States. In

2017, there were about 393.3 million privately owned guns in the United

States. At that time, the U.S. population was less than 326.5 million

people, with an average of about 120.5 guns per 100 people. In second place

is war-torn Yemen, with 52.8 guns per 100 people. The United States ranks

first in the world in terms of the total number of private gun owners and

the number of guns per capita. However, the number of registered private gun

owners is only about 1.07 million. The vast majority of guns are

unregistered and lost to the public status (https://www.en84.com/14210.html).

14. Rational welfare policies and government welfare housing:

Reasonably adjust and integrate welfare policies, adjust government welfare

housing and affordable housing, and gradually sell existing government

welfare housing to existing residents at affordable and reasonable prices

with the consent of the residents, striving to provide all New Yorkers with

the opportunity to own in real estate, many people are both landlords and

tenants. They can move, rent, buy and sell houses freely, and fully protect

their property rights. It has become the place with the largest and best

quality housing per capita in the world and the fewest housing conflicts and

disputes!

New York now has a lot of welfare subsidies based on poverty, such as

Premium Tax Credit (medical subsidies), Medicaid (white card)

,

SNAP/Food Stamp

(food stamps),

Medicare Savings Programs red and blue card subsidies,

WIC (maternal

and infant) Child Nutrition Assistance),

School Lunch Program, CHIP (Children’s Health Insurance Program), Affordable

Housing Subsidy, etc. (https://www.dealmoon.com/guide/981641),

use a large amount of government funds from taxes.

The implementation of UBI will provide conditions for the reasonable

integration of various welfare subsidies, save a large amount of social

funds, improve efficiency, and provide the best conditions for the further

development of New York and the improvement of New Yorkers' living

conditions.

Strengthen social protection and ensure social welfare programs are

streamlined and focused on providing essential support to those in need.

Strengthen the welfare of the elderly, disabled people and those who really

need care. Evaluate and reevaluate existing programs to maximize

effectiveness and efficiency, considering the well-being of all New Yorkers.

15. Invest in and rationalize public transport infrastructure:

Invest in New York's public transportation infrastructure to improve

transportation accessibility, reduce congestion, increase economic

productivity, reduce greenhouse gas emissions, increase job opportunities

and improve residents' quality of life. Build bus terminals where needed,

like Flushing. Stop unnecessary excessive bus lanes. Now New York is

constantly building dedicated bus lanes, which affects the normal driving of

ordinary vehicles and reduces the efficiency of public lane use. Appropriate

bus lanes are needed, but they must be built where they are really needed.

All public projects, especially projects that directly affect public

production and life, such as projects that require road closures or partial

road closures, must have a clear and reasonable plan, budget, and

construction time before starting work, and they must be implemented as

specified after construction starts. For projects that affect public

transportation and public life, strive for fast and efficient construction

20 hours a day, 7 days a week, with as little impact on public

transportation and public life as possible.

Achieve no blind spots in the entire New York network signal, including

subways, parks, basements of public places, etc.

16. Promoting prosperity and equitable education

:

Investing in first-class education, strengthening examination and

merit-based selection procedures, strengthening education programs, and

promoting the development of talented people can bring many benefits to

society. It creates a more knowledgeable and skilled workforce, promotes

technological and economic growth and innovation, and enables individuals to

realize their full potential. Quality education combined with a fair and

transparent selection process creates a level playing field and provides

opportunities for all to succeed based on their abilities and merits,

regardless of their family background or socio-economic status. In addition,

a well-educated and skilled population can promote social mobility, social

cohesion and overall social well-being, and promote and safeguard the

development of science and technology.

17. Promote economic growth - support high-tech enterprises and small and

medium-sized enterprises in New York City and establish a complete

industrial chain:

Supporting, protecting and promoting high-tech large enterprises as well as

small and medium-sized enterprises can bring many benefits. High-tech

large-scale enterprises can contribute to the economy by increasing

production, exports and income generation, while small and medium-sized

enterprises can inspire entrepreneurship, promote local development, and

provide employment opportunities that are relevant to daily life. By

creating an enabling environment for businesses of all sizes, New York can

create a diverse and dynamic economy that thrives on innovation,

competitiveness, and sustainability. Reduce production costs, especially

improve the competitiveness of the manufacturing industry, produce more

highly competitive products as much as possible, maximize economic market

liberalization, promote economic growth, put social development first,

stimulate economic growth, create employment opportunities, Promote

innovation and drive technological advancement. Increase New York's GDP,

build high-speed rail, subways, bridges, highways, real estate, and increase

personal income and assets. Each manufacturing industry has established a

complete industrial chain.

New York is a place rich in human and natural resources and a good natural

environment. New York's industry, agriculture, politics, economy, education,

technology, culture, finance, culture, transportation, tourism, wholesale,

retail, etc. are among the best in the world. If New York's governance is

good, it will have the best conditions in the world. No other place can

compare with New York.

18. Cultivate entrepreneurship – establish free markets:

Create more free markets in New York, such as flea markets. First, it

promotes entrepreneurship by providing small business owners and local

vendors with opportunities to sell goods and services. This can benefit both

consumers and businesses by boosting economic growth, creating jobs,

increasing competition and residents shopping. Furthermore, free markets can

enhance community engagement and social cohesion because they are also

gathering places where people interact, exchange ideas and build

relationships. Free markets also promote a city's cultural diversity and

vitality, and they often showcase unique products and crafts from different

cultures and communities. Overall, building more free markets creates a

vibrant and inclusive economic environment that promotes entrepreneurship

and contributes to New York’s social fabric and the lives of New Yorkers.

Establishing more free markets also provides more jobs that everyone can do,

and contributes to New York's goal of zero unemployment. The free market

provides jobs for everyone.

On the basis of review and control, we should try to open up the commercial

use of houses, short-term rental operations and legal residential use of

basements.

19. Promote and strengthen international cooperation and exchanges,

especially with Canada and China:

Canada borders New York and has close relations with the United States.

China is the world's second largest economy. It is crucial for New York to

strengthen cooperation and exchanges with Canada and China. Explore efforts

to open the border with Canada.

Taking advantage of New York's strong and attractive conditions, we will

further introduce that most of the world's top 500 companies have branches

in New York, and most of the world's top 500 universities have branch

campuses in New York. Make full use of the conditions, resources and

political influence of the United Nations, make full use of the conditions

and advantages of Wall Street, and strengthen international cooperation and

exchanges.

20. Promote the abolition of tipping habits:

In particular, stop mandatory tipping and incorporate tips into the price.

An important reason for tipping is that in the past, the commodity economy

was underdeveloped, the consumption and service situation in the society was

imperfect, and price uniformity was poor. Tips were used to regulate this.

In modern society, commodity consumption and services are more popular and

more complete. Sales and purchases are basically based on pricing, with

clearly marked prices. There is no need for tips to measure or improve

service attitude and quality. Today's tipping has become a compulsory

expenditure, which also causes annoyance and distress, and is not suitable

for the commodity market circulation services in modern society.

21. Change unreasonable parts of New York’s laws and regulations

:

Propose the government to change the unreasonable parts of New York's laws

and regulations, and propose new, reasonable laws and regulations that are

beneficial to the development of New York and the lives of New Yorkers.

Justice leads, excellence and responsibility!

There is a passage that says:

If you love someone, send him to New York, because that is heaven.

If you hate someone, send him to New York, because that's hell.

To be permanently in people’s minds:

If you love someone, send him to New York, because that is heaven.

If you hate someone, don't send him to New York, because that's heaven!

Running for New York State Governor,

2026

Dr. Hongbao Ma

Ma for New York

718-404-5362

mahongbaony@gmail.com

;

http://www.maforny.com

102-34 92nd Avenue, Richmond Hill, NY

11418

Hongbao Ma,

May 1, 2025, New York

----------------------------------

Election for the New York State Governor - 2026

Dr. Ma, Hongbao

Currently living in Queens, New York. Committed to comprehensively

developing the good in New York, eradicating the bad, and improving the

lives of New Yorkers.

Campaign Slogans:

Putting People First, We the People. Always: Our Commitment to Doing Right

and Doing Best!

There is a passage that says:

“If you love him, send him to New York, for it’s heaven. If you hate him,

send him to New York, for it’s hell.”

To permanently change to:

“If you love him, send him to New York, for it’s heaven. If you hate him,

don’t send him to New York, for it’s heaven.”

马宏宝-参选纽约州

长-2026

马宏宝,北京大学博士,哈佛大学博士后。从小关心时政、社会状况与发展,热心社会活动。面对纽约繁荣强大的一面及现存的严重问题,决定参选

2026

纽约州长,

为纽约的治理、安全、教育、科技、发展、繁荣等努力,聚焦纽约的社会治理、生活和发展,

致力于提高纽约居民生活品质及改善纽约的现状,

让纽约好的地方更好,不好的地方改正,进一步把纽约建设成为繁荣发展、和谐互助、安全幸福的美好家园。

参选纽约州长,

2026

马宏宝 博士

Dr. Ma, Hongbao

Ma for New York

718-404-5362

mahongbaony@gmail.com

http://www.maforny.com

竞选口号: